This is the first post in a four-part series on materiality.

After years of debate over the definition of materiality, 2020 has brought a consensus that materiality is double — meaning that businesses should report on financially material topics that influence enterprise value as well as topics material to the economy, environment, and people.

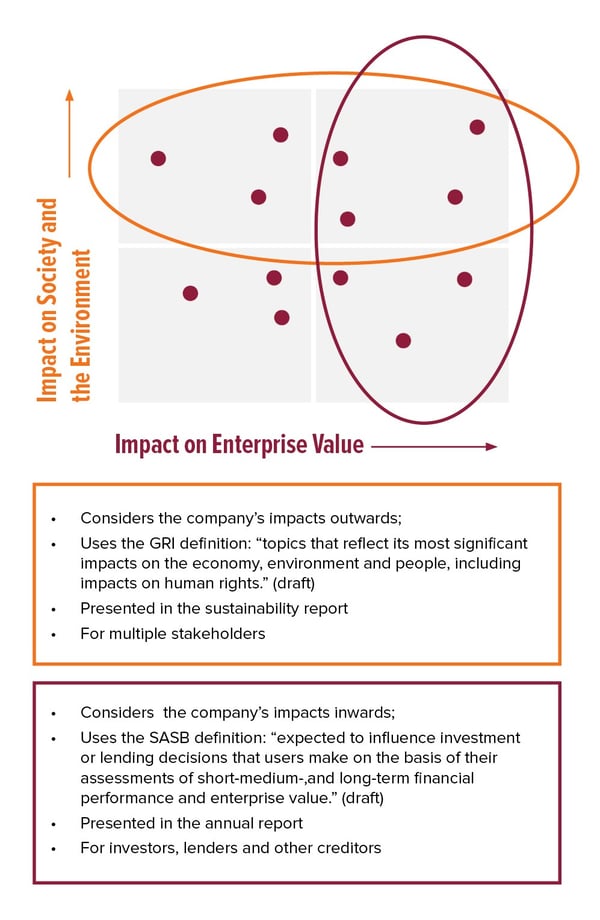

The new definitions of the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and the two papers published by the five reporting standard organizations helpfully clarify reporting standards’ different perspectives on the question “material to whom,” enabling greater interoperability between them:

- On the one hand, a company identifies and assesses those sustainability issues that influence enterprise value. We can also call this "financial materiality" or "impacts inwards." This is covered by the SASB definition of materiality. The main audience for this information is investors, lenders, or other creditors.

- On the other hand, a company identifies and assesses impacts on the economy, environment, and people. This refers to "environmental and social materiality" or "impacts outwards." This is covered by the GRI definition of materiality. The main audience is a broad set of stakeholders, including governments, consumers, business partners, responsible investors, employees, civil society organizations, local communities, and vulnerable groups.

Take the topic of climate change. A business will want to understand how physical and transition risks may impact its enterprise value. Severe weather events may affect the company’s manufacturing sites or supply chain security, or climate regulation may mean that some of its products and services are no longer relevant. On the other hand, the company emits carbon emissions that impact the environment and people’s livelihoods.

Take the topic of climate change. A business will want to understand how physical and transition risks may impact its enterprise value. Severe weather events may affect the company’s manufacturing sites or supply chain security, or climate regulation may mean that some of its products and services are no longer relevant. On the other hand, the company emits carbon emissions that impact the environment and people’s livelihoods.

Double materiality is also applicable to an issue like diversity, equity, and inclusion. In a talent-tight market, a company’s ability to attract a diverse workforce may improve its pool of talent and workforce productivity and influence its enterprise value. If a company has discriminatory practices, this may result in lawsuits or change of leadership, which could in turn negatively impact enterprise value. On the other hand, discriminatory practices constitute an infringement on civil and human rights.

However, some topics may constitute significant impacts outward without affecting enterprise value (top left quadrant of the matrix). Take the presence of conflict minerals in electronics companies’ supply chains. Minerals extracted in conflict zones are sold to perpetuate conflicts, affecting communities’ human rights and livelihoods. On the other hand, conflict minerals has not proven to negatively impact enterprise value.

Looking at the bottom-right quadrant, customer satisfaction will likely affect enterprise value. However, it might not constitute a significant impact on people, the environment, or human rights.

For the purposes of reporting, a business should engage its investors on topics that affect enterprise value (in the two right quadrants). The business will report to a wider range of stakeholders, such as consumers, business partners, and local communities, on significant impacts to the economy, the environment, and people (in the two top quadrants).

So, why should companies apply this concept of double materiality?

We hear from our members that despite having completed a materiality assessment, they still get questions from stakeholders about other issues that may not be material to their business. We hear that some topics like modern slavery get Board time and attention, even if this topic may not be material to the company. We hear that executives get tired of hearing that all sustainability issues are material topics, when actually they are not.

By applying the concept of double materiality, a company will be able to clearly distinguish between inward and outward impacts.

- A company should report on all its significant impacts outwards, regardless of whether they are material to the business. Applying the concept of double materiality will help answer stakeholder pressures for greater corporate transparency.

- The sustainability field has at times overestimated the impact of sustainability topics on the business. In our view, this can impede on the sustainability team’s ability to convey true priorities. By identifying those issues that are financially material, a sustainability team will be able to advance priorities that are truly a business concern.

- Understanding the link between inward and outward impacts of an issue will help the company build an adequate management plan, as well as report on these topics in a meaningful way to different stakeholders. When drawing a plan to manage an impact, e.g. labor rights in the supply chain, a business will be able to inform the plan with an understanding of whether this is a true risk for the business or whether this is part of the company’s responsibility to mitigate an impact on people.

As businesses are looking to refresh their materiality assessment, applying the lens of double materiality will help enhance the value of the assessment for reporting and strategy. We will continue to explore how to enhance the value of materiality assessments in this blog series. We are interested in hearing your thoughts and continuing the conversation about double materiality with our members. Contact us!

Denielle Harrison is a manager at BSR. She works with BSR member companies across various industries on materiality, strategy, and stakeholder engagement within BSR’s Sustainability Management practice. She also supports efforts on supply chain risk, greenhouse gas emissions reduction targets, and climate strategy. She leads Future of Fuels. Prior to joining BSR, Denielle focused on greenhouse gas accounting, sustainability reporting, solid waste management, and sustainability strategy for Dartmouth College.… Read More

Charlotte Bancilhon is an associate director at BSR. With strong project management skills and a background in CSR analysis, Charlotte supports companies in the financial services, consumer products, transport and logistics, and information and communication technology industries with advice on sustainability strategy, supply chain, and human rights. Charlotte leads BSR’s financial services practice in Europe. Before joining BSR, Charlotte was an analyst for nearly five years at Innovest and Vigeo,… Read More